charitable gift annuity rates

As an example if the annuitant lives only as long as their targeted life expectancy one regulation governing charitable. Barbara 72 transfers 20000 in exchange for a gift annuity.

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

A charitable gift annuity is a gift in exchange for a contractual obligation from Rutgers University Foundation to make fixed payments to you andor another beneficiary for life.

. You can establish a charitable gift annuity by making a gift to the UW Foundation in exchange for which you receive a fixed annual dollar amount for life. She is entitled to an income tax charitable deduction of about 42000 based on an IRS discount rate of 06 percent. With a charitable gift annuity you make a donation using cash marketable securities or other assets and the University in turn pays you a fixed income for life.

If Mary waits to make her gift after the new rate schedule is in place on July 1 the same gift amount will provide 1550 in annual payments reflecting a 62 rate. These annuity rates are designed to offer you an attractive payment stream while also securing a good gift for the charity. Charitable Gift Annuities.

This type of trust is a financial arrangement that allows a trustee to hold assets for one or more beneficiaries. Based on response to our most recent article on charitable gift annuities and feedback from thousands of our readers Annuity FYI has assembled a list of the Top 40 reader-recommended charities offering gift annuities. A charitable gift annuity functions as an exchange of a cash gift for a stream of payments for life.

The principal remaining at your death will then benefit any UW Foundation program that you choose. She will receive annual payments of 5400 from Stanford for the rest of her life. The American Council on Gift Annuities provides gift annuity rates to charities that write charitable gift annuities.

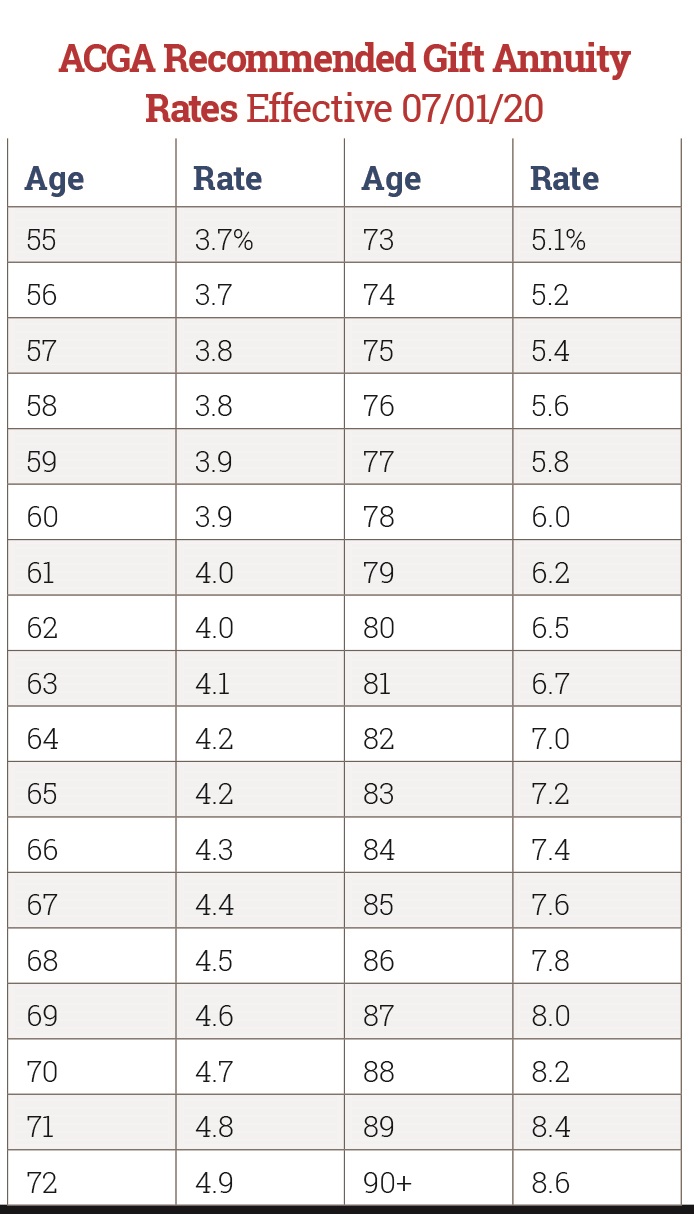

The American Council on Gift Annuities ACGA recently announced new suggested maximum charitable gift annuity rates effective July 1 2020. In exchange the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies. If you want to make the most of your lifetime income a retirement annuity may be a better option.

Charitable Gift Annuity Rates Most nonprofits that offer charitable gift annuities use rates established by the American Council on Gift Annuities ACGA. 2 What is the tax deduction for a charitable gift annuity. For many charitable organizations the minimum required gift for an annuity is 10000 or more.

And most investors are amazed at how many well known and many worthwhile but lesser known charities offer them. When you set up a charitable remainder annuity trust you may be eligible for some personal tax deductions for your charitable gift. Under the current rate schedule Mary 79 gives 25000 to us in exchange for a charitable gift annuity.

For immediate gift annuities these rates will result in a charitable deduction of more than 10 if the CFMR is 06 or higher whatever the payment frequency. Typically the life income goes to the donor or is shared as a 100 percent joint and. SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021.

Rutgers adheres to the American Council on Gift Annuities recommended maximum rates. 7 Who pays taxes on a gifted annuity. Jane Brown age 75 makes a cash gift of 100000 to Stanford this year in exchange for a charitable gift annuity.

With the new rates. If you wish to make a charitable donation while receiving an income tax deduction and fixed payments for the rest of your life a gift annuity may. Annuities for charitable gifts are often written by charities using gift annuity rates from the American Council on Gift Annuities.

8 How can I avoid paying taxes on annuities. The gift may be property that the charity can sell for cash like publicly traded securities or a cash sum that amounts to 10000 or more. The American Council on Gift Annuities ACGA is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout rates.

Charitable gift annuity rates vary from charity to charity and are based on several factors including the amount of the gift as well as the donors ages at the time of the gift. 4 Are gift annuities taxable. The rates are for ages at the nearest birthday.

Two Lives Joint Survivor Younger Age Older Age Rate Younger Age Older Age Rate Younger Age Older Age Rate 60 60 - 62 36 70 70 - 72 42 75 81 - 83 5 60 63 - 95 37 70 73 - 75 43 75 84 - 86 51. This is a payout rate increase of approximately 74 percent. Barbara receives annual payments of 1160 a rate of 58 percent.

With the old rates. Jones will receive 590000 per year as long as at least one of them survives. She will receive annual payments of 1650 a rate of 66.

The annuity rate corresponding their ages is 59. 5 Can you lose your money in an annuity. For more information on the background and the solution we are working on with the New York Department of Financial Services please click here to read more.

3 Are charitable gift annuities a good investment. It is a permanent and legally binding agreement. Jones both age 70 transfer 100000 on January 1 2008 to a charitable organization in exchange of a joint and survivor life immediate payment charitable gift annuity.

Northwestern has raised its gift annuity rates effective July 1 2018. 6 How much does a 100000 annuity pay per month. A charitable remainder annuity trust CRAT is an option for estate planning.

The rates for charitable gift annuities are often lower than those offered by insurance companies. A CGA is one of the easiest forms of planned giving. Additionally these charities adhere to the councils regulations and recommendations.

1 What are the benefits of a charitable gift annuity. 125 rows NOTES. Barbara received annual payments of 1080 a rate of 54 percent.

The exact amount of that gift is agreed upon at inception. Generally the recommended payout rates have been lowered by 03 to 05 percentage points based on the donors age. In exchange for an immediate gift to a legitimate 501 c 3 charity the donor is promised a specified lifetime income.

Younger donors may often see significantly lower rates based on the longer expected term. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Establish minimum gift sizes and rate schedules.

The ACGA suggested rate schedule is designed to. The rates are now the highest they have been in years.

Giving To Tulane New Charitable Gift Annuity Rates

Good Health Is Wealth Annuities As Well As Tax Obligation Annuity Tax Tax Money

Great New Rate On A Six Year Fixed Annuity Safety Of Principal And Interest Earned Guaranteed Interest Each Year Investing Strategy Investing Gold Investments

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

Letter Of Intent Sample Letter Of Intent Lettering Intentions

Compelling Stories Market Charitable Gift Annuities Most Effectively

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities Uses Selling Regulations

Letter Of Intent Sample Letter Of Intent Lettering Intentions

Charitable Gift Annuity Rates To Become More Attractive July 2018 Alabama West Florida United Methodist Foundation

Gifts That Pay You Income Earthjustice

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Acga Charitable Gift Annuity Rates

Charitable Gift Annuity Rate Increases Texas A M Foundation

City Of Hope Planned Giving Fall Annuity

Logo Metlife Logo Top Web Designs Web Design Projects

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home